India’s Private Credit Market has entered a phase where scale, structure, and execution discipline matter more than novelty. Yield compression across traditional fixed income, coupled with episodic volatility in public markets, has accelerated allocations toward assets that combine short duration, predictable cash flows, and contractual downside protection. Within this context, Trade Receivable Securitisation (TRS) also known as Accounts Receivables Securitisation has emerged as an investable asset class that converts operating cash flows from India’s real economy into institutional-grade credit exposure.

This article explains TRS through an investor lens and outlines why Family Offices and Sophisticated Allocators are increasingly viewing it as a core Private Credit strategy rather than an opportunistic sleeve.

India’s Turn Toward Structured Private Credit – The Macro Landscape

India’s economic growth continues at a pace that outstrips many large economies, while the structure of credit intermediation evolves in parallel. Bank balance sheets remain selective, and Debt mutual funds operate under tighter liquidity and duration constraints. Meanwhile, corporate working capital needs expand across supply chains that serve FMCG, pharmaceuticals, auto components, logistics, and industrials.

The result is a widening gap between demand for short-term operating credit and the supply of flexible, non-dilutive capital. Private credit fills this gap when it offers three attributes’ investors value today.

- Insulation from market beta

- Visibility into cash flows at the asset level

- Governance and legal certainty comparable to capital markets instruments

Trade Receivable Securitisation sits at the intersection of these requirements. It channels private capital into verified trade flows while maintaining structural protections that senior investors expect from securitised debt.

Defining Trade Receivable Securitisation as an Investable Asset Class

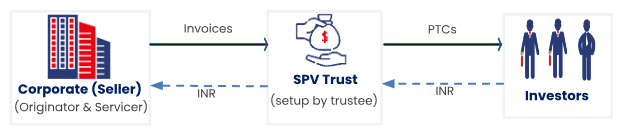

Trade Receivable Securitisation involves pooling accepted B2B invoices and converting them into tradeable securities issued by a bankruptcy-remote vehicle. For investors, the distinction lies in what is being financed. These are not retail loans or long-dated project exposures. They are short-tenor trade claims that arise from completed delivery of goods or services.

From an investment standpoint, TRS converts account receivables that sit dormant on corporate balance sheets into liquid instruments with defined cash flow waterfalls. The receivables amortise quickly, often within 30 to 90 days, and replenish through a controlled pool during the investment period. This creates a duration profile that remains short even when the legal maturity extends longer.

Importantly, TRS operates under SEBI’s Securitised Debt Instruments framework, with Pass-Through Certificates held in demat form, rated by external agencies, and overseen by independent trustees. This regulatory architecture places TRS firmly within the universe of capital markets credit, even though the underlying assets originate from operating trade cycles rather than loan books.

For investors, the outcome is exposure to India’s trade economy with contractual cash flow priority and defined risk boundaries.

The Family Office: Fit for India

Family Offices in India and offshore increasingly seek assets that compound capital steadily without forcing binary risk decisions. Trade Receivable Securitisation aligns well with this mandate for four reasons.

- Cash flow visibility remains high. Each investment pool is backed by invoices that are accepted and digitally verifiable, with collections routed through trustee-controlled mechanisms.

- Duration stays short. Even when pools replenish over time, the underlying receivables turn rapidly. This reduces sensitivity to rate cycles and allows capital recycling.

- Risk-adjusted returns remain attractive. Senior TRS tranches deliver yields that compare favourably with longer-dated corporate bonds while maintaining exposure to short-tenor assets.

- Correlation stays low. Trade receivable performance links more closely to consumption and supply chain velocity than to equity markets or long-duration rates.

For Family Offices managing multi-generational capital, the above characteristics of TRS translate into greater portfolio stability. TRS behaves less like a tactical credit trade and more like a predictable income engine anchored in real economic activity.

Risk Mitigation Without Complexity for Investors

Institutional adoption of any new asset class depends on risk containment rather than theoretical return potential. TRS structures address this through layered safeguards that operate simultaneously.

Bankruptcy remoteness ensures that receivables sold into the structure remain insulated from originator insolvency. Over-collateralisation and subordinated capital provide loss absorption ahead of senior investors. Diversification caps limit exposure at obligor, sector, and pool levels. Independent trustees control cash flows, while external ratings provide ongoing surveillance.

What matters for investors is not the mechanics of each covenant but the outcome. Senior tranches receive priority access to collections with predefined triggers that shift pools into amortisation when performance metrics breach thresholds. This creates a self-correcting structure that favours capital preservation.

The Vayana TRS Advantage

While securitisation frameworks exist on paper, execution capability determines whether TRS works at scale. Vayana acts as the Architect and Manager of India’s first successful end-to-end Trade Receivable Securitisation lifecycle.

Our proprietary framework utilizes a multi-layered validation process that screens receivables before entry and monitors them continuously through the trade cycle. This validation and monitoring engine integrates invoice data, trade acceptance, and payment behaviour in near real time. It forms the primary barrier to entry for participants who view TRS as a documentation exercise rather than a systems-driven credit strategy.

The proof point lies in outcomes. Vayana structured and managed a corporate-originated TRS transaction that progressed from initiation through replenishment to full principal repayment with all scheduled distributions met. This closed-loop execution matters. In private credit, being early carries limited value unless the structure demonstrates performance through stress, monitoring, and exit. The completed lifecycle establishes TRS as a repeatable asset class rather than a bespoke transaction.

Unlocking Liquidity from the Real Economy

At a macro level, India carries a large quantum of working capital locked in account receivables across its supply chains. Traditional financing channels address only a fraction of this pool due to collateral requirements and operational friction.

TRS reframes this problem. It allows corporates to unlock liquidity without adding on-balance sheet leverage, while investors gain access to trade-linked cash flows with structural protection. This alignment explains why TRS increasingly features in discussions among private credit funds, debt mutual fund managers, and family offices seeking differentiated fixed income exposure.For investors, the asset answers a simple question. How can capital earn stable returns while remaining close to the underlying economy and insulated from market volatility. Trade Receivable Securitisation provides a credible response.

Looking Ahead

India’s private credit market will continue to deepen as regulatory clarity, digital infrastructure, and institutional participation converge. Within this landscape, TRS occupies a distinct position. It combines the discipline of securitised credit with the resilience of short-duration trade flows.

For family offices and sophisticated allocators, the opportunity lies in engaging with managers who have demonstrated full-cycle execution and built proprietary capabilities that extend beyond legal structure.

Investors seeking a deeper understanding of this strategy may request the case study on India’s first successfully repaid TRS transaction or schedule a private briefing on structured private credit opportunities. These sessions focus on portfolio outcomes, governance, and performance rather than product promotion, and are designed for institutions evaluating TRS as a long-term allocation within their credit portfolio. To know more write us at [email protected]